Our products and tools allow IT Managers and Finance Managers who oversee tax and compliance operations to meet local Brazilian requirements within the global ERP systems their companies deploy.

Reduce cost and the effort required to deliver tax obligations in Brazil

Ensure compliance and avoid costly fines

Increase your competitive advantage in the market while still meeting all tax requirements

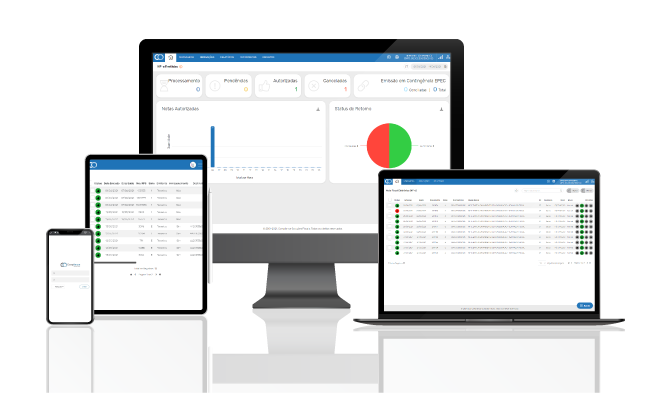

AUTOMATE YOUR WORK PROCESSES

Full Web,

100% Java,

Single Database,

Tax Solution and Messaging in a single Workspace.

DIFFERENTIALS

FOR IT

- Ease of Migration – The Compliance Tax Solution can be deployed on premise or in the Cloud with easy data migration between platforms.

- Technical Requirements – Centralized access to information in a single database, native ETL and Tax Intelligence tools that ensure greater reliability and compliance.

- Technology – 100% web based and built using Java, the Compliance Tax Solution leverages a single Oracle database ensuring best in class data integrity.

- Investment – Lowest total cost of ownership in the market. Implementation and maintenance requirements are streamlined and cost less than similar competitors.

DIFFERENTIALS

FOR TAX

- Navigation – Our user friendly interface provides a single work area with intuitive design to allow for efficient work across multiple divisions, locations, and legal entities.

- Auditing – Developed with Native Tax Intelligence, we deliver a set of more than 6,000 information validation rules integrated into the product, ensuring total compliance and reliability of the electronic files sent to FISCO.

- Adherence – The Compliance Tax Solution is the only option in the market that includes both tax and messaging solutions integrated in a single Cloud product.

- Training – Compliance’s proprietary remote learning options offer training and certification options for client users.

RECOGNITION

AUTHORITY

TECHNOLOGY

INNOVATION

SECURITY

OUR CUSTOMERS

SOLUTIONS DEVELOPED BY SPECIALISTS

TAX AND HUMAN CAPITAL

+20

Sales

Partners

+07

Full Stack Partners

ERP + Compliance

+90

Direct

Employees

+150

Consultants

in the ecosystem

+600%

Growth

in the last years

98%

Satisfaction

at support

companies

have simplified their processes

and achieved their objectives

Learn about the History of Compliance Solutions (PT-BR)

COMPLIANCE SOLUTIONS is a Brazilian company specialized in tax compliance, human capital management and credit card reconciliation.

Latest Blog Posts (PT-BR)

Solução Fiscal SAP: tudo sobre automação do processo com SAP Miro Migo

Tem alguma dúvida de como funciona a automação do Miro e Migo por uma Solução Fiscal SAP? Então tire-a agora neste material completo!

Oracle NetSuite: 20 fatos curiosos e imperdíveis sobre o ERP!

Neste texto, vamos detalhar um pouco da história da NetSuite, hoje Oracle NetSuite, como tudo começou, algumas curiosidades e fatos.

Tecnologia na educação: como a transformação digital está impulsionando o setor?

Como a tecnologia na educação é capaz de fazer diferença para a sua empresa? Confira o nosso material sobre o assunto e entenda.

Latest news (PT-BR)

eSocial – Novo Cronograma – Portaria Conjunta SEPRT/RFB/ME 71/2021

Esta Portaria Conjunta dispõe sobre o cronograma de implantação do Sistema Simplificado de Escrituração Digital de Obrigações Previdenciárias, Trabalhistas e Fiscais (eSocial). *O empregador doméstico fica obrigado ao envio do evento S-2210 do leiaute do eSocial a...

Publicação da Versão 8.0.7 do Programa da ECD

Foi publicada a versão 8.0.7 do programa da ECD, com as seguintes alterações: - Correção do erro na recuperação de ECD anterior com centro de custos; e - Melhorias no desempenho do programa no momento da validação. O programa está...

Implantação da versão S-1.0 do eSocial e eventos de folha de empregadores pessoa física começam a partir de 19 de julho

Publicada a Portaria Conjunta SEPRT/RFB/ME nº 71/2021 que atualiza o cronograma de obrigatoriedade. O envio de eventos de folha de pagamento para as pessoas físicas pertencentes ao 3º grupo inicia a partir de 19/07/21 relativos a todo o mês de julho. Período de...

eSocial: Cronograma de implantação é prorrogado; confira as datas

O Diário Oficial da União publicou nesta sexta-feira (02) a Portaria Conjunta SEPRT/RFB/ME nº 71/2021 que altera o cronograma do eSocial devido ao atraso na implantação da versão simplificada (versão S-1.0). De acordo com o texto, a implantação do layout...

CPOM/ISS: decisão pode reduzir a carga tributária de prestadores de serviço

O plenário do Supremo Tribunal Federal (STF) declarou, em recente decisão, inconstitucional o Cadastro de Empresas de Fora do Município (CPOM), colocando um fim a uma antiga discussão e à exigência imposta aos prestadores de serviços estabelecidos em outros...

ESocial: Layout S-1.0 ganha nova data e cronograma é alterado

A Portaria Conjunta SEPRT/RFB/ME nº 71/2021 publicada no Diário Oficial da União da sexta-feira (02) altera a implantação do layout simplificado (versão S-1.0) do eSocial para o dia 19 de julho, substituindo o prazo anterior de 17 de maio. Com a mudança no cronograma,...

Publicação da Versão 7.0.7 do Programa da ECF

Foi publicada a versão 7.0.7 do programa da ECF, com as seguintes alterações: 1 - Correção do problema na importação de valores negativos nos registros X305 e X325. 2 - Correção do problema da recuperação de dados da ECD quando um trimestre é arbitrado. 3 - Melhorias...

Publicação da Versão 8.0.7 do Programa da ECD

Versão 8.0.7 do Programa da ECD Foi publicada a versão 8.0.7 do programa da ECD, com as seguintes alterações: Correção do erro na recuperação de ECD anterior com centro de custos; e melhorias no desempenho do programa no momento da validação. O programa está...

Prorrogado o prazo de entrega da EFD-Reinf e DCTFWeb

Foi assinada nesta quarta-feira a Portaria RFB nº 43, de 16 de junho de 2021, que prorroga o prazo de entrega da Escrituração Fiscal Digital de Retenções e Outras Informações Fiscais (EFD-Reinf) e da Débitos e Créditos Tributários Federais Previdenciários e de Outras...

NF3-e – Consulta Tabela Classificação Produtos (cClass)

Informamos que agora a consulta a tabela cClass existe como um serviço do portal que acessa diretamente o banco de dados de autorização, retornando exatamente os cClass que são validados pelo ambiente. A consulta traz informações importantes dos grupos de cClass como...

Compliance Events:

GRSST - 04/11

HCM Especialistas - 22/11

Webinar REINF - 29/11

Addresses

Addresses

Rua Apeninos, 429 | 3rd floor

01533-000 | São Paulo | SP

Rua Milton José Robusti, 75 | 9th floor | Jardim Botânico

14021-613 | Ribeirão Preto | SP

Phone numbers

Phone numbers

+55 (11) 3512-9960

+55 (16) 3516-9600

Email

Email

WhatsApp

WhatsApp

+55 (11) 98114-4762

Check out our Instagram

Compliance Solutions | All Rights Reserved | Reproduction Forbidden