We specialize in helping our clients achieve legal and statutory requirements in Brazil!

%

Customer Satisfaction

%

On Time SLA

Companies using the Compliance Public Cloud

Selected from more

than 1,200 companies

Compliance is THE industry leading tax reporting and payroll partner solution for Brazil

Have you been searching for a partner that can provide a complete solution for payroll and tax reporting that is fully integrated with Oracle’s ERP and HCM products in Brazil? Look no further.

You have found us!

Risks Related to Brazilian Tax Requirements and Potential Non-compliance!

Brazilian tax laws are complex and can change over time. This dynamic environment means that Oracle Cloud solutions, even fully localized ones, won’t always meet all your statutory requirements in Brazil.

For this reason it is essential to have integrated solutions provided by Oracle certified partners to meet the different legal requirements related to tax reporting and payroll. Using Compliance will allow you to reduce costs, mitigate risks, and increase productivity.

Through innovative technology offerings that include automated intelligent validations across a 100% cloud platform, Compliance will help you meet all your statutory requirements in Brazil in a way that will deliver competitive advantages to your business.

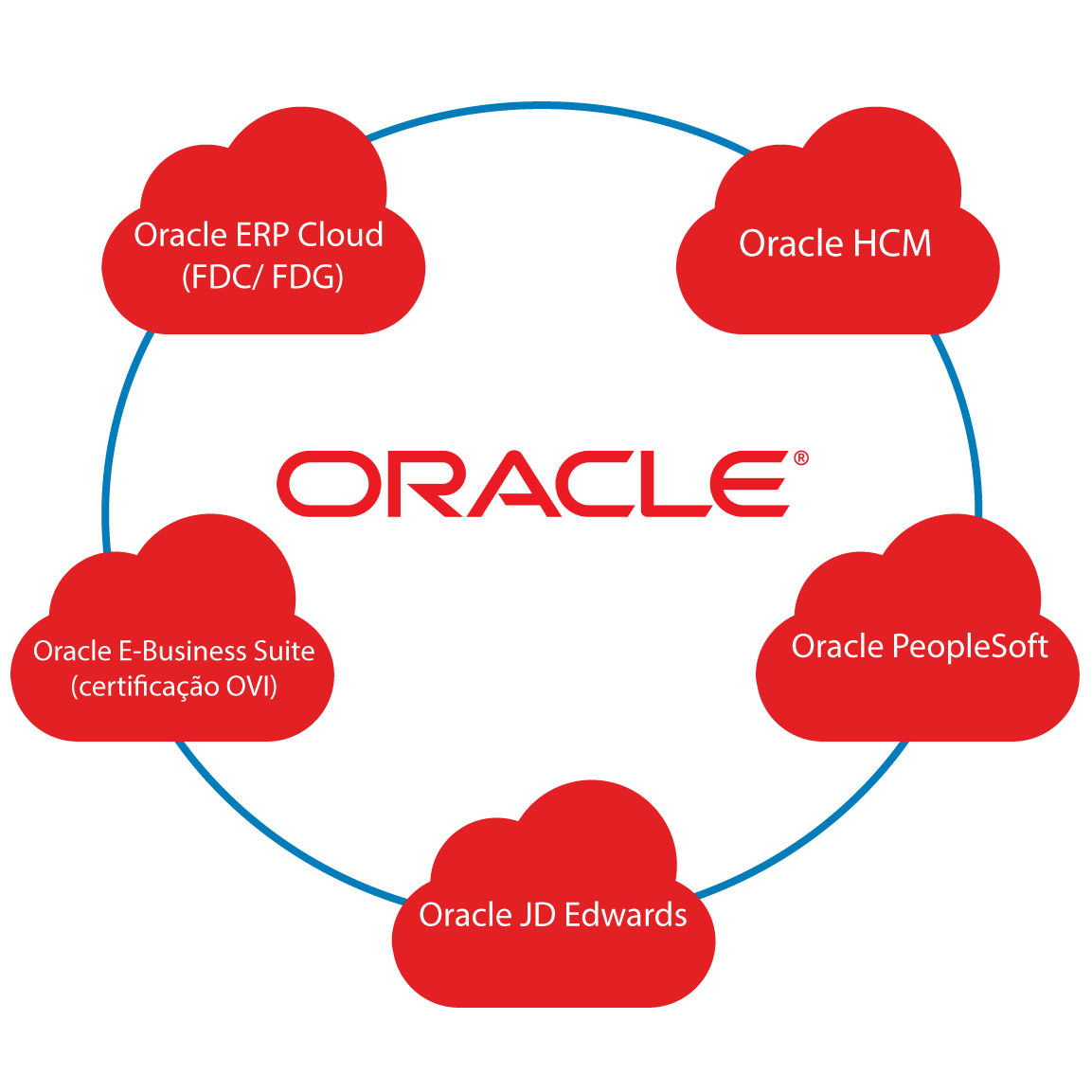

100% Cloud Based Platform and Oracle Certified Integrations

Integrated with:

- Oracle ERP Cloud (FDC/ FDG)

- Oracle E-Business Suite

- Oracle JD Edwards

- Oracle PeopleSoft

- Oracle HCM

Benefits:

- IT Maintenance and Infrastructure Cost Reductions.

- User autonomy, Controls, and Safety.

- Meets all Brazilian Tax and Payroll Requirements.

- Conformity to the brazilian legislation.

- Payroll, Electronic Timecard Control, and SESMT totally focused on eSocial.

- Reliable Information Through Tax Validation Rules.

Groundbreaking Success Story – The First Implementation of Oracle ERP Cloud in Brazil with Localized Tax Reporting and Electronic Invoices

Modular Architecture Fit to Your Business Needs

Our Solution at Compliance is integrated with Oracle’s different ERP product offerings and available I several modules. This approach allows for a lower initial investment and can be tailored to suit individual business requirements.

Digital Tax Bookkeeping (EFD) for ICMS and IPI

Inventory Management (Bloco K)

Digital Accounting Bookkeeping (ECD)

Tax SPED (EFD) for PIS and COFINS

EFD-Reinf

Flexibility to meet all federal, state, and municipal obligations.

Compare and choose the right Brazilian Partner

Best in Class User Experience

Electronic Invoices and Tax Obligations are all available within a single application. Compliance’s user interface was engineered to be intuitive and easy to navigate. Having a single source of information across all modules sets the Compliance solution apart from other competitors in the market.

Architecture and Technology

The Compliance Solution was developed using Java and runs on 100% web services without the need for emulators to tie together solutions built on out of date technology. Micro services ensure our systems perform at high speeds even during times of peak usage. Other competitors in the market have built their solutions on older technology such as Visual Basic and Power Builder. These legacy technologies introduce security risks and performances issues that can be difficult to mitigate in the world of today’s fast paced cloud IT environments.”

Implementation Costs

Compliance has certified integrations built on true web 2.0 technologies with both Oracle and SAP. This allows for rapid implementation projects and lower overall cost of ownership than other competitors in the market.”

Audit and Internal Controls

The Compliance solution was engineered with tax intelligence built into three independent levels of automated review. The system is comprised of more than six thousand individual validation rules. Most other competitors deploy older solutions that require either custom built ETI audit solutions or the need to hire outside auditors to mitigate risks.

Ease of Migration

Our solution is built to allow for easy migration from on premise to the cloud or vice versa depending on individual business requirements.

Investment and Price

With a total cost of ownership as much as 50% less than other competitors, the Compliance solution clearly offers the highest ROI in the market today.

Dozens of Success Stories

Cloud and On Premise Options

Cloud

Compliance offers the only 100% cloud solution for electronic invoicing and tax reporting requirements in Brazil!

On Premise

Rapid deployment to your own hardware and environment is available via our proprietary methodology and the solution is completely integrated with INFOR ERP.

Start Now!

Consider hiring Compliance as your one stop BPO partner instead of implementing a local ERP solution in Brazil. With our suite of products and experts we can meet all of your tax, electronic invoice, and payroll requirements in Brazil.

Compliance is experienced in solving common challenges faced by multinational companies in Brazil, and our solution is easily integrated with most large international ERP systems.

Thanks to the cloud, and our modular approach, Compliance can architect a solution that will be ready to hand over for your own management once your business is up and running in Brazil.